Company Incorporation in Macau

Why Macau?

Under the policy of “one country, two systems”, the Macau Special Administrative Region of the People’s Republic of China (“Macau”), maintains its own legal system, as well as a local taxation and company registration system.

With a strong influence from the Portuguese legal system, Macau’s commercial and civil laws are familiar to foreign investors dealing with any European civil law system, as well as to those coming from Portuguese speaking countries.

Generally speaking, there are no restrictions on foreign shareholding / foreign investment and local tax and registration authorities offer efficient, straightforward and speedy services (e.g., a company will be registered in approximately three weeks upon the filing of the respective registration petition and complete set of incorporation documents).

In order to incorporate companies in Macau the respective directors and shareholders do not have to be physically present in Macau, representatives can be designated to execute the incorporation documents and subsequent registration.

Moreover, there are no exchange controls or currency regulations in Macau aside from general Anti Money Laundering / Financing of Terrorism legislation.

In short, a competitive taxation framework, a “free port” policy and a familiar legal system, make Macau an attractive destination to those seeking to incorporate a company.

Main Business Vehicles

There are two main types of companies incorporated in Macau and these are the most suitable options for foreign investors:

Private Companies Limited by Quotas (in Portuguese “Sociedades por Quotas”) and Private Companies Limited by Shares (in Portuguese “Sociedades Anónimas”).

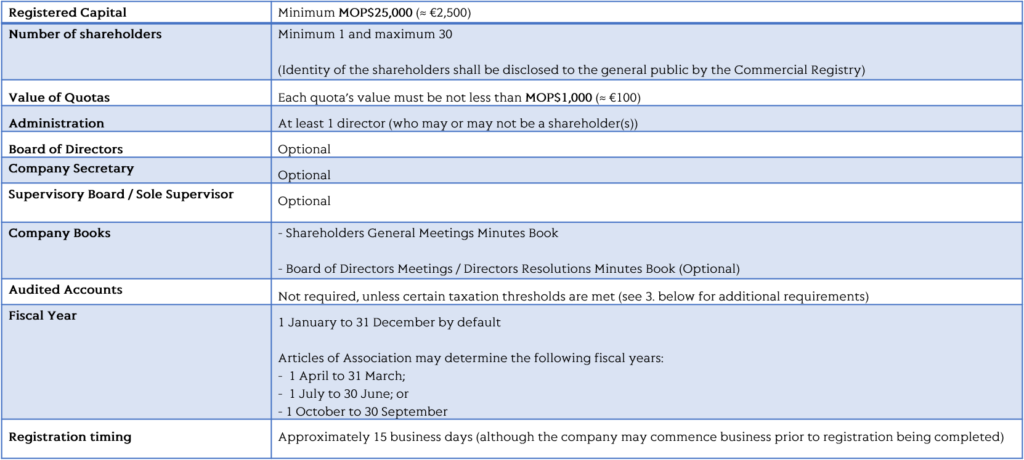

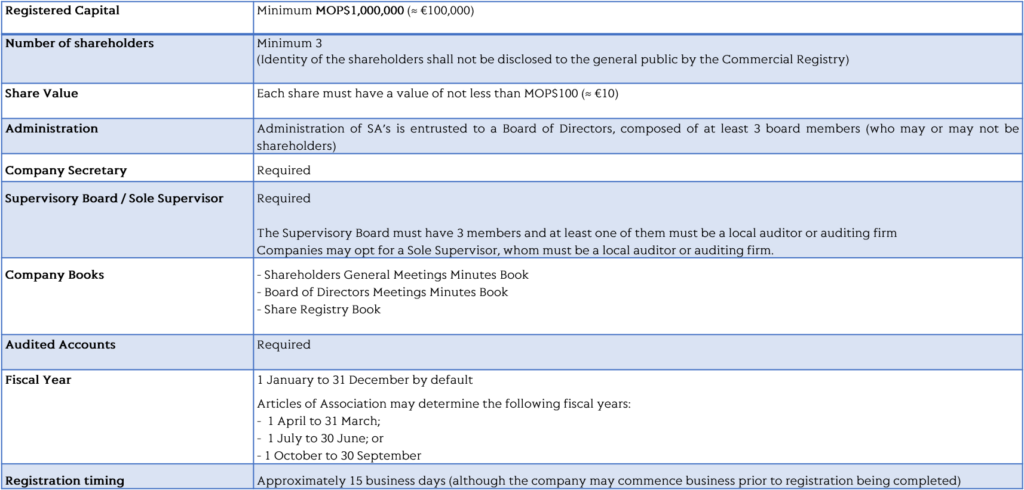

Below is a brief outline of the requirements to incorporate a Private Company Limited by Quotas (“SPQ”) or a Private Company Limited by Shares (“SA”) in Macau.

Private Companies Limited by Quotas (“SPQ”)

Private Companies Limited by Shares (“SA”)

Taxation and Social Security Contributions

Main Taxes applicable to Companies in Macau

Macau’s taxation system is relatively simple and low on red-tape requirements.

The main taxes which local companies are subject to are:

I. Industrial Tax (in Portuguese “Contribuição Industrial”);

II. Income Tax (in Portuguese “Imposto Complementar de Rendimentos”); and

III. Professional Tax (in Portuguese “Imposto Profissional”).

Other taxes such as stamp duty or property taxes may also apply, depending on the line of business conducted by the companies (and applicable to certain transactions).

Below is a brief outline of the main applicable taxes:

I. Industrial Tax

Macau government has been exempting the payment of Industrial Tax for several years. However, newly incorporated companies are still required to register with the Macau Financial Services Bureau and submit a declaration of commencement of business for Industrial Tax purposes.

II. Income Tax

Income tax is payable by local businesses over taxable income earned in Macau and on foreign jurisdictions.

Currently, income tax is charged at a rate of 12% on taxable income over MOP 600,000 (approximately €60,000). Taxable income below the threshold of MOP 600,000 is not taxed.

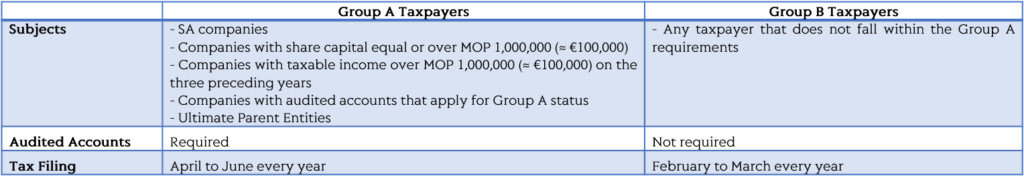

Income Tax subjects are split into Group A and Group B taxpayers, as follows:

III. Professional tax

Individuals who receive an income derived from employment or self-employment are subject to professional tax, at progressive rates of up to 12% above a threshold of non-taxable income (which is currently set at MOP 144,000 / year (≈ €14,400)).

Usually, companies are required to withhold the payment of employees’ professional tax on a quarterly basis (every year in January, April, July, and October).

Social Security Contributions

Local companies which have employees are required to pay the following social security contributions:

I. Resident Employees

a. Full time employees:

MOP90 (≈ €9) per month (employer’s share: MOP60 (≈ €6) / employee’s share: MOP30 (≈ €3)).

The contributions are paid quarterly by the employer (which will withhold the employee’s share) every January, April, July and October.

b. Part-time / Casual employees:

MOP90 (≈ €9) per month for each part-time / casual worker who works 15 days or more in a given month (employer’s share: MOP60 (≈ €6) / employee’s share: MOP30 (≈ €3)).

MOP45 (≈ €4.5) per month for each part-time / casual worker who works less than 15 days in a given month (employer’s share: MOP30 (≈ €3), employee’s share: MOP15 (≈ €1.5))

Contributions are paid monthly by the employer (which will withhold the employee’s share).

II. Non-Resident Employees

Generally, an employment fee of MOP200 (≈ €20) per month for each non-resident worker is fully paid by the employer.

The contributions are paid on a quarterly basis every January, April, July and October.

Feel free to contact us for more information.